Study: Only one-third of Indians prioritise saving for retirement

On a scale of 0 to 100, India's Retirement Index (at 44) indicates a one-year delay in urban India's action towards retirement planning.

India Retirement Index Study

HYDERABAD: The India Retirement Index Study finds that only 1 in 3 Indians places a high priority on financial preparation for retirement. The second edition of the survey's second edition shows that the India Retirement Index is still at 44, and that dependence on family and children remains a significant obstacle to planning for retirement investments.

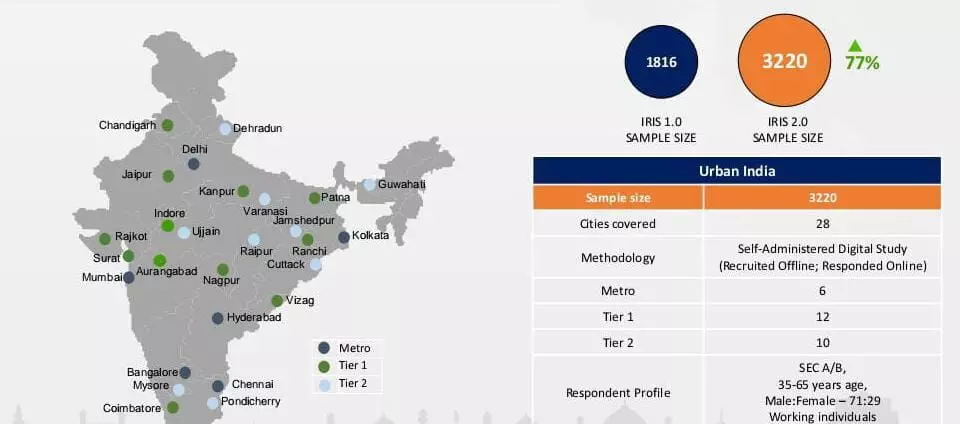

The second edition of the "India Retirement Index Study" was released on Thursday by Max Life Insurance Company Ltd. in collaboration with KANTAR (IRIS). The poll measures urban India's readiness for a long, happy, and financially secure retirement.

The survey evaluates whether urban India is ready to retire and lead a happy, healthy life. 3,220 people from 28 cities—including 6 metros, 12 Tier I cities, and 10 Tier II cities—were surveyed as part of a self-administered digital study.

The poll indicates the underlying levels of retirement readiness in the country over the past year, despite the fact that India's life expectancy has been steadily increasing over the years.

On a scale of 0 to 100, India's Retirement Index (at 44) indicates a one-year delay in urban India's action towards retirement planning. A significant drop from 62 to 59 in emotional preparedness, which indicates a high dependency on family, friends, and social support during retirement, was observed while the health and financial preparedness scores were at 41 and 49, respectively.

According to the report, 23% of Indians do not even know how to start planning for retirement. More than 90% of people over 50 regret delaying their retirement savings and investments. strong belief among most that "earlier is preferable," since 59% anticipate money will run out within 10 years of retirement. Life insurance is viewed by 69% of people as the best product for retirement savings. Metro areas in the east are the most prepared for retirement. Even though the index for both genders is almost the same, males seem to be more financially worried than women.

Prashant Tripathy, Managing Director and CEO, Max Life Insurance, said, "As India's life expectancy increases and health trends change, the country's elderly population is projected to grow nearly 41% to 194 million by 2031. There is also a review underway of the retirement age in India to align it with the increasing life expectancy. As industry and the wider ecosystem take steps in a positive direction, the robust and well-represented study reveals that Indians are also realising the need to plan for retirement early. However, the awareness is yet to translate into action in terms of proactively saving and investing. When it comes to retirement planning, all Indians must embrace the "earlier the better" philosophy and start planning at a young age to ensure their retirement years provide them an opportunity to live a healthy and financially independent life. As we unveil the findings of IRIS 2.0, we urge India to realise the importance of timely retirement planning and encourage them to work towards securing their future. "

Soumya Mohanty, Managing Director and CCO, Insights Division, South Asia, Kantar, remarked on the findings of the survey, "IRIS 2.0 offers a compelling perspective on how urban Indians view and plan for retirement. It aims to help Indians comprehend the approach and give due importance to planning for retirement in their lives. In today's world, it's important to stay financially independent at all times, especially during one's retirement years. We are pleased to partner with Max Life Insurance in safeguarding urban India's financial security across all stages of life. "