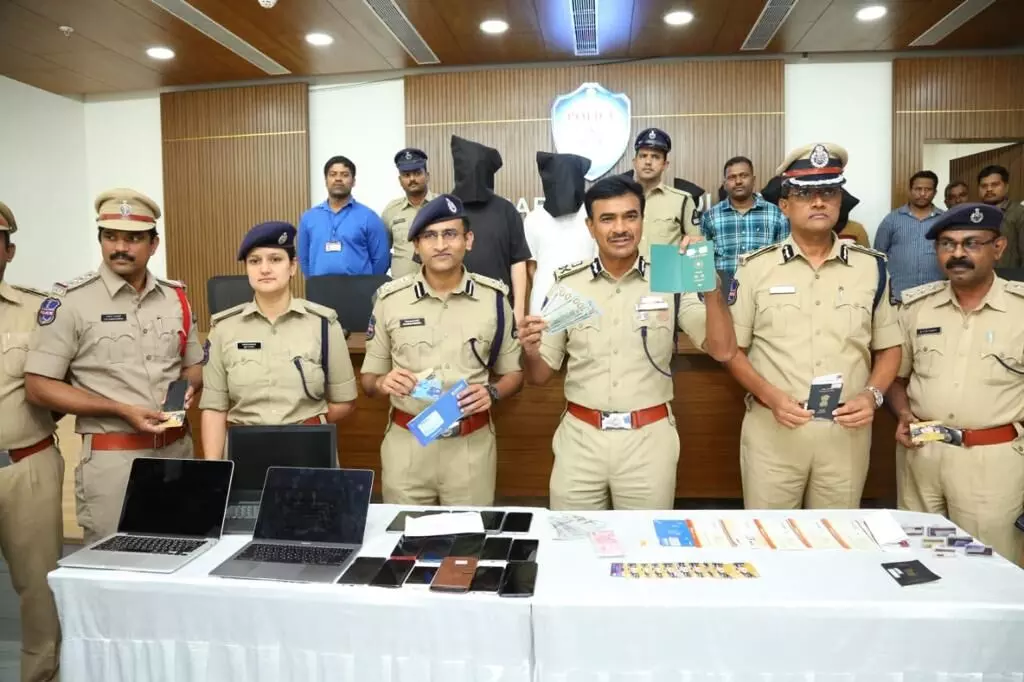

Hyderabad police bust Rs 903-cr Chinese investment fraud; 10 arrested

In a span of seven months, Rs 441 crore worth of transactions were executed on the account of Ranjan MoneyCorp Pvt Ltd.

HYDERABAD: The Hyderabad Cyber Crime Police (CCS) police on Wednesday arrested 10 persons including two foreign citizens in connection with a Chinese investment fraud involving a Rs 903 crores hawala scam.

A Tarnaka resident lodged a complaint with the Hyderabad city police, alleging he was duped after investing Rs 1.6 lakh in an investment app called LOXAM. It was discovered that the complainant's money was deposited in an IndusInd Bank account in the name of Xindai Technologies Pvt Ltd.

This bank account was registered in the name of one Virender Singh of Xindai Technologies Pvt Ltd, according to Hyderabad Commissioner CV Anand. When Virender Singh was apprehended and questioned in Pune, he confessed to opening a bank account in the name of Xindai Technologies Pvt Ltd on the instructions of a man named Jack (a Chinese). He also gave Jack the account's internet banking username and password.

Investigations revealed that Xindai Technologies Pvt Ltd and Betench Networks Pvt Ltd's bank accounts use the same phone number. On Li Zhounjau's orders, Sanjay Kumar in Delhi opened the Betench account and gave it to Pei and Huan Zhuan in China. He also opened 15 other bank accounts and transmitted the information to Chu Chun-yu, a temporary Mumbai resident from Taiwan who was detained yesterday in Mumbai. Chu Chun-yu distributes SIM cards, user IDs and account information to foreign nations. Li Zhounjau arranged for Sanjay Yadav and Virender Rathor to get Rs 1.2 lakhs commission per account.

Money was transferred from Xindai Technologies Pvt Ltd's account to 38 other bank accounts, according to CV Anand. Additionally, it was transferred to Syed Sultan and Mirza Nadeem Baig's accounts in Hyderabad.

According to Parvez's instructions, Mirza Nadeem Baig and Syed Sultan opened bank current accounts for the purpose of commission. Parvez then transferred those bank accounts to Imran, who lives in Dubai. Imran and others used these two bank accounts to commit investment fraud.

A large sum of money was transferred from Xindai Technologies Pvt Ltd's 38 accounts to Ranjan MoneyCorp and KDS Forext Pvt Ltd. Navneet Kaushik then transfers the funds from the bank account to the Forex exchanges operated by International Tours and Travels. He converts the currency from Indian Rupee to US Dollar and gives it to Sahil and Sunny through RBI licenced money changers and Forex exchanges. However, they have repeatedly violated the RBI's guidelines for money-changing activities. Sahil and Pankaj collaborated with other fraudsters to transfer the aforementioned funds abroad via hawala.

In a span of seven months, Rs 441 crore worth of transactions were executed on the account of Ranjan MoneyCorp Pvt Ltd.

Transactions of an additional Rs 462 crore were made on the KDS Forex Pvt Ltd account.

The investigation indicated that fraud had been committed through hawala to the extent of Rs 903 crore. A total of Rs 1.91 crores from several bank accounts have been frozen in this case.

Hyderabad residents Sahil Bajaj, Sunny, Virender Singh, Sanjay Yadav, Navneeth Kaushik, Mohammad Parvez, Syed Sultan, Mirza, and Nadeem Baig were arrested, as were Li Zhongiun (Chinese) and Chu Chun-yu (Taiwan national).

A case has been registered with the Cyber Crime branch of the Tarnaka police station based on the complaint of the Tarnaka resident.